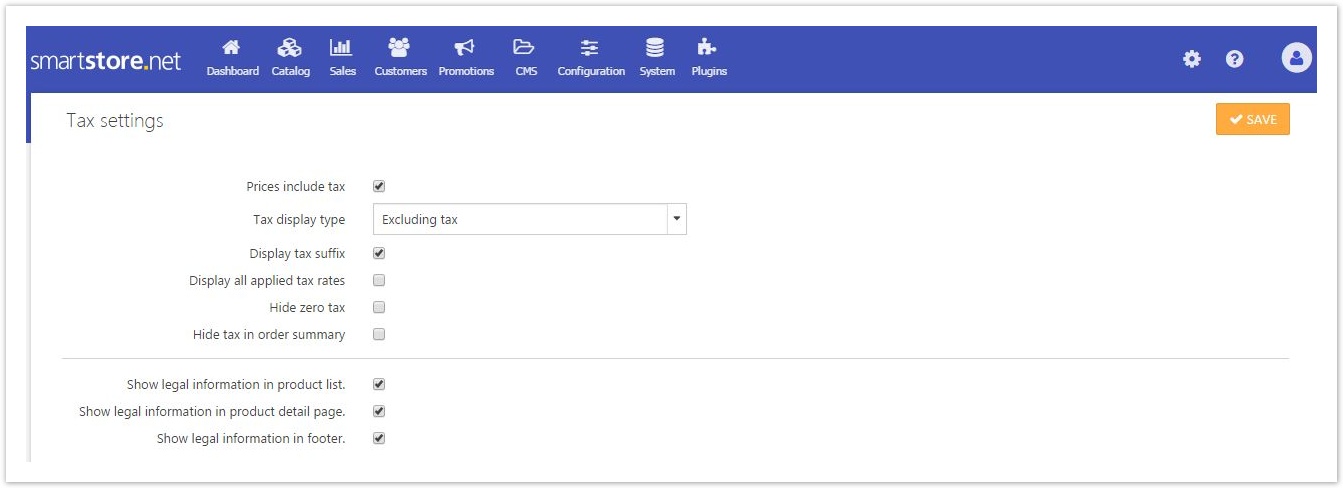

Tax Settings

| 250px|Input field | Explanation |

|---|---|

Prices Include Tax | A value indicating whether entered prices include tax. |

| Tax Display Type | Tax display type. |

| Display Tax Suffix | A value indicating whether to display a tax suffix (incl tax/excl tax). |

| Display All Applied Tax Rates | A value indicating whether each tax rate should be displayed on a separate line (shopping cart page). |

| Hide Zero Tax | A value indicating whether to hide zero tax in the order summary. |

| Hide Tax In Order Summary | A value indicating whether to hide tax in the order summary when prices are shown as tax-inclusive. |

| Show Legal Information In Product List | Check the box to show legal information in the product list. |

| Show Legal Information In Product Detail Page | Check the box to show legal information in the product detail page. |

| Show Legal Information In Footer | Check the box to show legal information in the footer. |

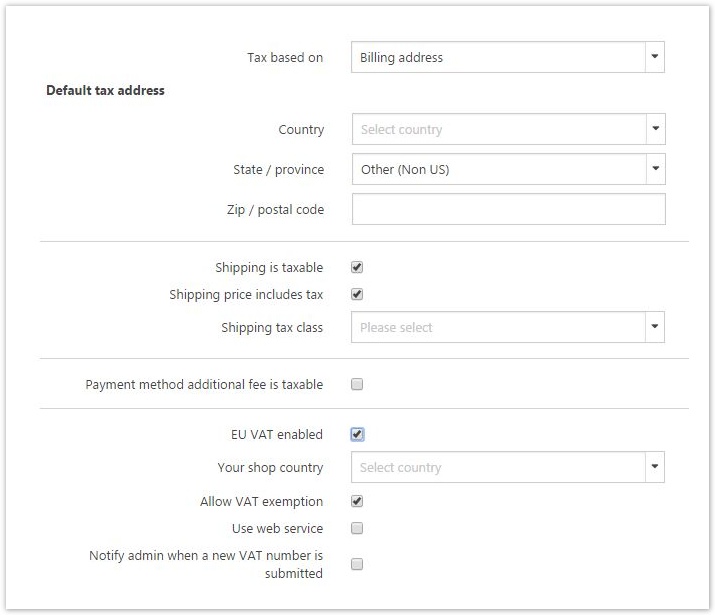

Default Tax Address

| 250px|Input field | Explanation |

|---|---|

Tax Based On | Tax based on. |

| Country | Select country. |

| State / Province | Select state or province. |

| Zip / Postal Code | Enter zip or postal code. |

| Taxing of auxiliary services | Specifies how to calculate the tax of auxiliary services like shipping and payment fees.

|

| Shipping Is Taxable | A value indicating whether shipping is taxable. |

| Payment Method Additional Fee Is Taxable | A value indicating whether the payment method additional fee is taxable. |

| EU Vat Enabled | Check the box to enable EU VAT (the European Union Value Added Tax). |